Sponsored By: Fundrise

You don’t have to be IN real estate to invest in it. Fundrise is an easy-to-use platform that lets you build, grow and manage a diversified portfolio of high-end private real estate projects across the US. These are the same types of investments that power the largest pension funds, endowments, and sovereign wealth funds.

Fundrise offers significantly deeper diversification and outsized performance potential — a true alternative to any public market asset. They have become America’s largest direct-to-investor real estate platform by digitizing, automating, and integrating almost every aspect of the private investment industry in order to maximize your long-term return potential.

With Fundrise, you can achieve true portfolio diversification at the touch of a button. Find out how 210,000+ investors from all sizes are diversifying their portfolios with our private real estate investments.

I’m excited to have a guest post today from Kyle Harrison. In the past, he’s worked at firms like Coatue and Index Ventures, and for the last few months has been writing about the rapidly evolving VC landscape at Investing 101. Today he’s going to dive into the examples he’s seen of when cash is a king maker and when it's a kiss of death.

What's In a Moat?

For the last few years in startupland, cash was a commodity. Startups were stuffed full of capital from family offices, hedge funds, and me and other people like me in venture capital. Now however, the paradigm has shifted. Cash is more difficult to raise and the world is increasingly giving 2001 popped tech bubble vibes. If this apocalypse comes to pass, investment dollars will become more scarce. Cash will cease to be a commodity. The key question that all entrepreneurs and investors must ask is when does cash become a competitive advantage?

Everyone loves to talk about moats in business. Are they defensible? Are they differentiated? One heated debate is around whether a moat can consist of cash. However, it isn’t just whether or not it is a “moat” but whether it’s defensible. Does that cash allow a firm to maintain market share and profits?

In building a business there are no sure bets. You can have the most tenured executives, the most advanced technology, the strongest tailwinds, and the most direct access to capital and still fail. You can also have little more than an idea and a computer but still be wildly successful. Cash can only ever be a part of the equation.

When you look at a number of case studies in industries that have sucked up a lot of the venture cash floating around you see some insightful patterns. The advantage a business can get from having a huge amount of cash typically has more to do with the underlying market dynamics, maturity, and user economics, than it does with the cash itself. In other words? All cash-spending activities don't create equal results.

There is a common thread across industries that have come up as I've dug into the cash habits of the rich and the famous (companies). The first is a mindset. Some of the companies that have used cash most effectively have had a particular mindset while the ones who most abused cash had a very different perspective. The second is a focus on particular metrics. When thinking through how much of an advantage cash can provide there are some key metrics that can be most telling. Once you understand the mindset and the metrics around cash we can walk through case studies like Uber or Snowflake and better understand the way these companies have operated. Up first? Mindset.

A Paranoid Abundance Mindset

Your attitude towards money will always have more impact than how much money you actually have. For better or for worse. One of the most opulent examples of a cash inferno mindset is WeWork. A company that stands basically alone in having its downfall come from nothing other than simply filing an S-1 and letting the public look under the hood.

If you don't remember the fall of WeWork very well you might be thinking, "wait, didn't COVID have something to do with it?" Insanely enough? No. WeWork released their S-1 to a gobsmacked public in August 2019 after having raised over $12B in funding and seeing their valuation skyrocket to $47B. Things unraveled pretty quickly after that. The CEO stepped down in September, SoftBank took control of the company in October, and WeWork laid off 2,400 people in November. Today? WeWork is finally a public company trading at ~$5B.

What was the behavior that so shocked the world and led to one of the biggest unravelings a company has seen? An insane attitude towards spending, burning $2B a year in cash, pointing to their widely-ridiculed "community-adjusted EBITDA profitability," and the CEO claiming “energy and spirituality” as more relevant metrics for its potential in public markets than measures of its revenue and losses.

A more recent example is Fast. In November 2020, when Fast was roughly 18 months old they were raising opportunistic rounds far ahead of product-market fit because they believed they could "close a round on favorable terms due to conditions in the VC market." That opportunistic attitude was the driver behind bringing on more cash, regardless of the product or customer demand. That round eventually came together when Stripe led a $102M Series B in January 2021.

That cash-induced confidence pushed Fast to grow their headcount to ~500 people leading to a cash burn of $10M per month. At revenue of ~$600K that was $1,200 per employee. In a stream of cash-incinerating activities you hear about $90K events thrown in Tampa, corporate retreats in Honolulu and Denver, and corporate coaches flown in who work with professional athletes. All of this is indicative of a mindset that is filled with abundance and lacking any paranoia.

Any company can have a plan for how they approach their spending habits. But the public markets can often stand in for Mike Tyson. "Everyone has a plan until they get punched in the face." Developing a strategic mindset around how you spend cash isn't a function of simple frugality. The mindset is meant to help with maintaining scrappiness and leveraging cash in the most effective way possible. So how can you measure how effective you've been with your cash?

Some of the most effective managers of cash seem to have found the perfect balance in their mentality between paranoia and abundance. The market correction of the last few months has reminded a lot of people why paranoia is a necessary ingredient. We're not talking about just being a penny-pincher and hoarding cash under a mattress. The most effective operators understand cash is a weapon that needs to be used effectively. There are some key metrics that cut through the noise and help identify the most effective spending habits.

Metrics That Matter

For financial nerds there is a lot to love when looking at a company's P&L. But the sexiest thing about a company isn't the size of its revenue or even its growth rate. It's the cash conversion cycle! How effectively does a company turn cash into more cash? This isn't only how effectively you manage operations or how high your margins are. It's also optimizing your business model to most effectively finance your operations.

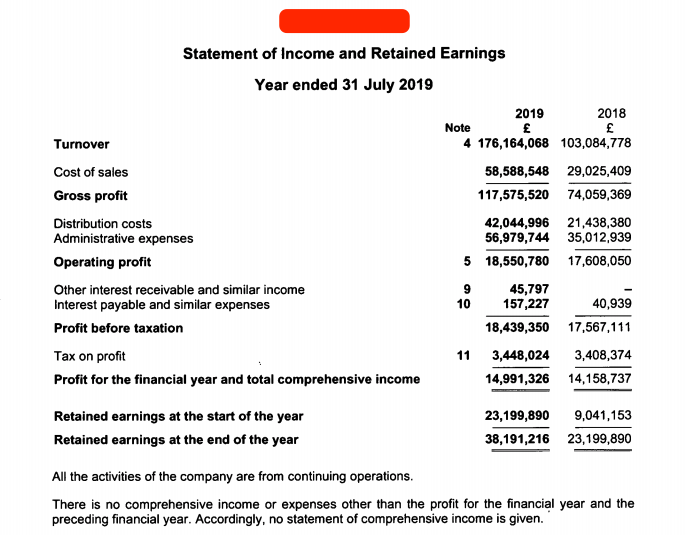

Jay Vasantharajah laid out a great example using Gymshark's financials. They have a negative cash conversion cycle. "A negative cash conversion cycle means that your vendors finance your operations and no extra cash needs to be invested as you grow."

The reason cash conversion is so fascinating and powerful is because it is actually a pretty effective way to compare businesses apples to apples. If the ultimate purpose of a business is to eventually generate reliable streams of cash flow, then how effectively the business takes in cash and turns it into more cash is a key question to ask.

Bessemer has done a great job explaining the concept of cash conversion for cloud software companies. Their straightforward calculation is a proxy for ARR created for every dollar of cash burned.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!