Just as quantitative trading revolutionized finance in the 1980s, AI is ushering in a revolution in growth and marketing. That’s the argument from Coframe founder Josh Payne in this week’s Thesis. The new era of AI-driven growth, Payne writes, will push us forward toward a truly optimized future where businesses can better reach new audiences and turn them into happy customers.—Kate Lee

Was this newsletter forwarded to you? Sign up to get it in your inbox.

I was first exposed to the field of growth when my last company scaled from zero to unicorn status in just two years—in large part because of our team’s growth marketing efforts.

My initial impression was that growth marketers had an innate, almost mystical, sense of how to drive metrics. They were masters of finding creative ways to reach new audiences, turn those audience members into prospects, and convert those prospects into happy customers. They were “business whisperers.”

It was not unlike the impression most people have about traders who work in finance. They assume it’s a dark art of experience and instinct.

Yet even the most data-driven and logical traders still have flaws and biases, which quickly compound. In financial trading, gut instincts lead to poor decisions.

Why am I making this comparison between trading and growth? These two fields seem worlds apart. Trading is East Coast—stocks, bonds, pressed suits, and dress shoes. Growth is West Coast—viral growth loops, north star metrics, hoodies, and sneakers.

As it turns out, growth, like trading, is both an art and a science. It’s not mystical, but grounded in creating hypotheses, running experiments, and using metrics to rigorously drive success. Today, as the founder of Coframe, an AI growth copilot for websites, I know the truth: Growth people are indeed business whisperers, but their whispering is both systematic and measurable.

And now, AI is fueling a new revolution in growth and marketing: a quantitative one. Let’s look at how the quant revolution that transformed finance is doing the same to growth, the early quant experimentation strategies that are working today, and how growth and marketing teams can win by mastering it early.

But first, we need to first look at how quantitative trading ate the finance world.

Sponsored by: Every

Tools for a new generation of builders

When you write a lot about AI like we do, it’s hard not to see opportunities. We build tools for our team to become faster and better. When they work well, we bring them to our readers, too. We have a hunch: If you like reading Every, you’ll like what we’ve made.

How the market was solved

Two mathematicians sat facing each other amid a scattering of charts, reports, and statements. The first mathematician, Leonard Baum, reflected sullenly, “How could this have happened?” At one point, he was unstoppable. Their fund, Monemetrics, had—in the three short years since its founding in 1981—racked up over $43 million in profit. Monemetrics was on track to become one of the highest-performing hedge funds in the world.

But, as they say, in a bull market, everyone’s a genius. Following its meteoric rise, Baum’s position, built from instinctive trades and a “buy-and-hold” mentality, had gone the way of Icarus—plummeting to 40 percent in losses, triggering a clause in the fund’s operating agreement, and liquidating the entire position.

“There was no rhyme or reason,” the second mathematician thought. He was right. Jim Simons had built a career as a differential geometrist, living within a theoretical world of order, logic, and rationality. But the market is none of those things. Its movement is far too complex for any human mind to comprehend. It would not be solved on gut instinct alone.

When this painful truth sank in, Simons started over. He went on to found a new firm, Renaissance Technologies (RenTec), from the ashes of Monemetrics, and introduced what is perhaps the most important revolution in modern-day finance: quantitative trading.

Quantitative trading (or “quant trading”) hinges on a few tenets:

- Quantitative information is indicative of underlying patterns in the market.

- Computers can process and compute these patterns much more quickly and effectively than humans can.

- Algorithms can use this information to predict patterns in the market.

If you can predict patterns in the market, you’ve solved it. This early insight—using data and quantitative methods to predict patterns in the market—allowed RenTec to generate better returns than any known trading firm in history. One hundred dollars invested in RenTec’s Medallion Fund in 1988 would be worth over $400 million today.

The rest is history. Discretionary (human-driven) trading accounted for less than 10 percent of the total trading volume, as estimated by JP Morgan…back in 2017. That number is likely even lower today. Quant trading has eaten the finance world.

What Simons—and, eventually, the rest of the world—realized was that in decision-making, the way to consistently outperform everyone else is to have the best data and make the best use of it. While some traders can still outperform in longer-horizon discretionary trading, the majority of capital is best allocated to the machines.

What does all this have to do with growth?

A new era of quant experimentation

In trading, the objective is to place a series of trades to increase the value of a portfolio. This starts with market research. We use indicators—such as company fundamentals, volatility, and momentum—to deepen our understanding. As we learn about the market, we start to identify patterns and develop hypotheses about assets that the market has mispriced. But we only have so much capital, so we place our bets based on the conviction we have in our hypotheses. If we’re right, we will beat the broader market; that outperformance is called alpha. The portfolio grows, and the cycle continues.

Let’s consider experimentation, which is at the core of growth. In experimentation, we run a series of tests to increase a core business metric. Effective experimentation starts with researching the audience and product. We use indicators and second-order metrics and tools—such as heatmaps, segment information, and user journey statistics—to deepen our understanding. As we learn about the audience and product, we start to identify patterns and develop hypotheses about how to improve our metrics. But we only have so much website traffic and team bandwidth, so we place our bets based on the impact we think each will have. If we’re right, our new website will have a higher conversion rate than the original; that outperformance is called lift. The business grows, and the cycle continues.

Sound familiar? In both cases, we are making thoughtful decisions about where to “invest.” We can choose to make small, safe, incremental bets, or take big, high-volatility, high-return swings. The psychology (and emotional roller coaster) is similar.

Experimentation in digital products is relatively new. A/B testing didn’t become widespread until 2010, and only over the past decade or so have tech companies more widely adopted disciplines like growth engineering. But the early signs already seem to favor quantitative approaches.

Sean Colombo, the vice president of engineering at Duolingo, attributes the company’s exponential growth directly to their experimentation: The quicker you launch winning experiments, the quicker those changes impact your growth. Colombo references Duolingo’s experimentation with push notifications as a primary lever for their growth.

While the idea of letting machines optimize user experiences is not new—recommendation algorithms are central to social networks like Instagram, TikTok, and Facebook—key challenges have prevented us from applying quantitative trading strategies to broader surface areas.

In particular, the outputs are vastly different. In trading, outputs are decisions on whether to buy or sell, which are purely numerical. Given the right input data, the simplest machine learning algorithms have proven quite capable of outperforming humans.

In experimentation, however, the outputs are different modalities entirely: product experiments or variants, which consist of combinations of copy, images, code, and user journey logic. Let’s say we have a pricing page that has a radio button layout—with the options stacked, like the Bloomberg pricing page—and we want to test a two-column layout, like the Wall Street Journal pricing page. This requires a design team to produce new visual designs, a content team to produce any additional content, an engineering team to write the code, and so on.

Enter generative AI.

Suddenly, we have a magic intelligence that is able to crunch the hyper-complex modalities of language, code, and vision in a principled and data-driven fashion—and with increasing ease. That pricing page change we were concerned about earlier? It can now be done in minutes, rather than in weeks, with the correct tooling and setup. We can use signals that human teams typically don’t even bother to consider in order to drive lift. We can optimize across hundreds or thousands of experiments rather than just a few—and we can do it continuously. The only remaining bottleneck is the traffic available, and even here we can use quantitative methods to squeeze more juice out of this traffic and, eventually, personalize our user interfaces entirely one-to-one.

This is a wholly new kind of experimentation—quant experimentation.

How to win with quant experimentation

Quant trading didn’t start out using microwaves for nano-second-level trade execution or satellite imagery to count cars in parking lots. Quant trading emerged from humble beginnings, with relatively simple strategies like mean reversion and pairs trading performing well early on. Over the decades, as strategies matured and new approaches were discovered, quant trading became an essential tool in the financial toolkit.

In the same way, quant experimentation will evolve to become an essential tool in the growth toolkit. But we don’t have to wait decades to see a couple of basic quant experimentation strategies that are working today, in order of increasing complexity:

Experiment ideation and planning: Ask an LLM

At a recent dinner that Coframe hosted for growth engineering heads of Meta, Netflix, OpenAI, Microsoft, and other companies, many mentioned that they already regularly use off-the-shelf models to generate experiment ideas. For example, they might give ChatGPT a screenshot of a landing page and ask it to recommend ways to increase conversion, and it might suggest adding social proof above the fold of your landing page, tweaking a form that has multiple fields visible to only exposing one at a time to minimize user commitment and friction—or, yes, changing a button’s color from green to red. This approach is surprisingly effective even with minimal context, but it becomes more powerful when you incorporate historical experiment results and backlogs, more information about the audience, and a system that allows the model to iteratively learn what works best over time, which leads to…

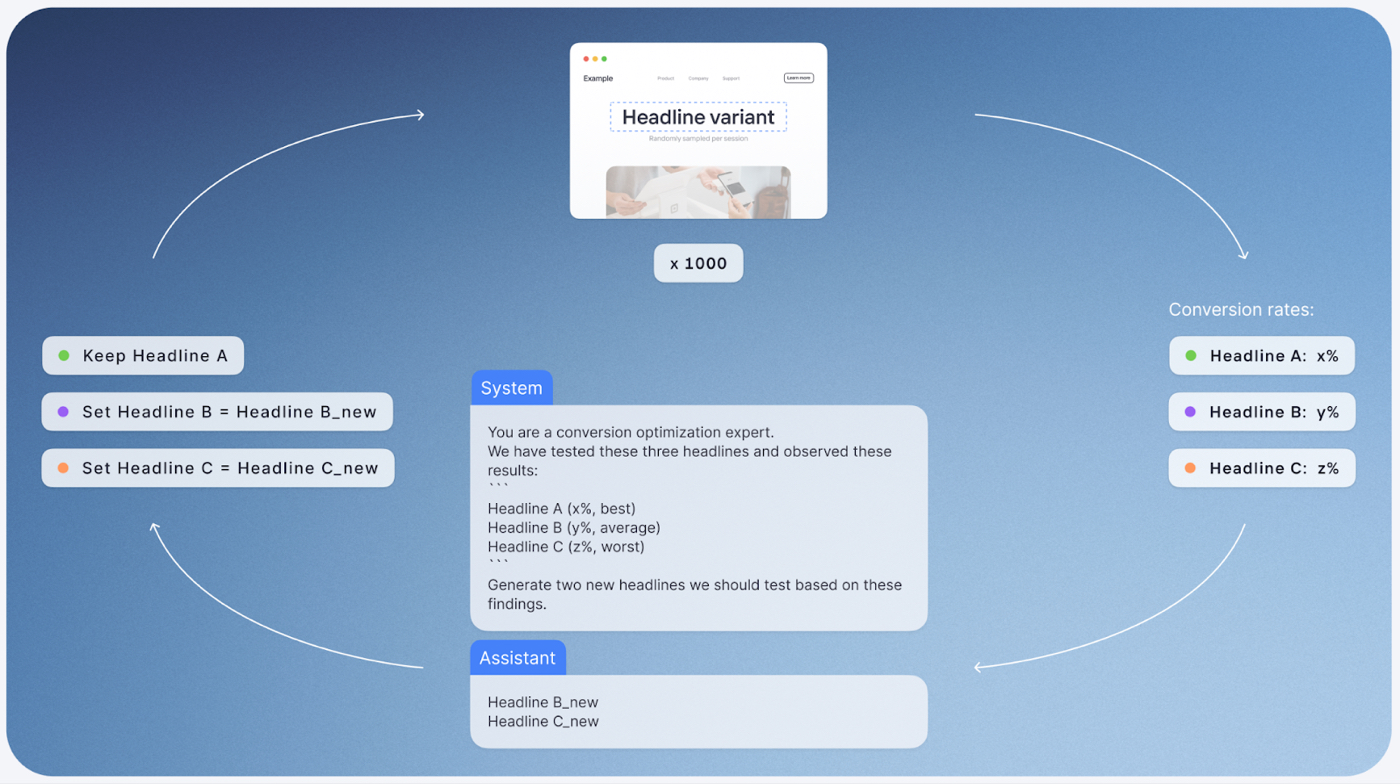

Continuous content optimization: Headlines that improve themselves

Landing pages, messaging campaigns, and other public-facing user experiences rely on engaging content to convert visitors into customers. But because of the manual work involved in creating this content and collecting feedback on its performance, marketing and growth teams traditionally only test a few variations in a given experiment. AI automates most of this, letting us move through the feedback loop not only quickly but continuously.

Here’s a simplified example of how we might apply this quant experimentation strategy to a website headline. The system generates a few headline variants, which are tested in randomized trials on the site. Based on the results, we generate a few new headlines to replace lower-performing ones (while balancing the tradeoff between exploration and exploitation), incorporate these new headlines in the next trial, and repeat the cycle ad infinitum.

AI helps to continuously optimize a website headline. Source: Coframe/the author.Continuous optimization in this way also has the benefit of preventing content from becoming stale. The process may involve a human in the loop to approve or guide the variations, but at its core, it is inherently machine-driven and quantitative.

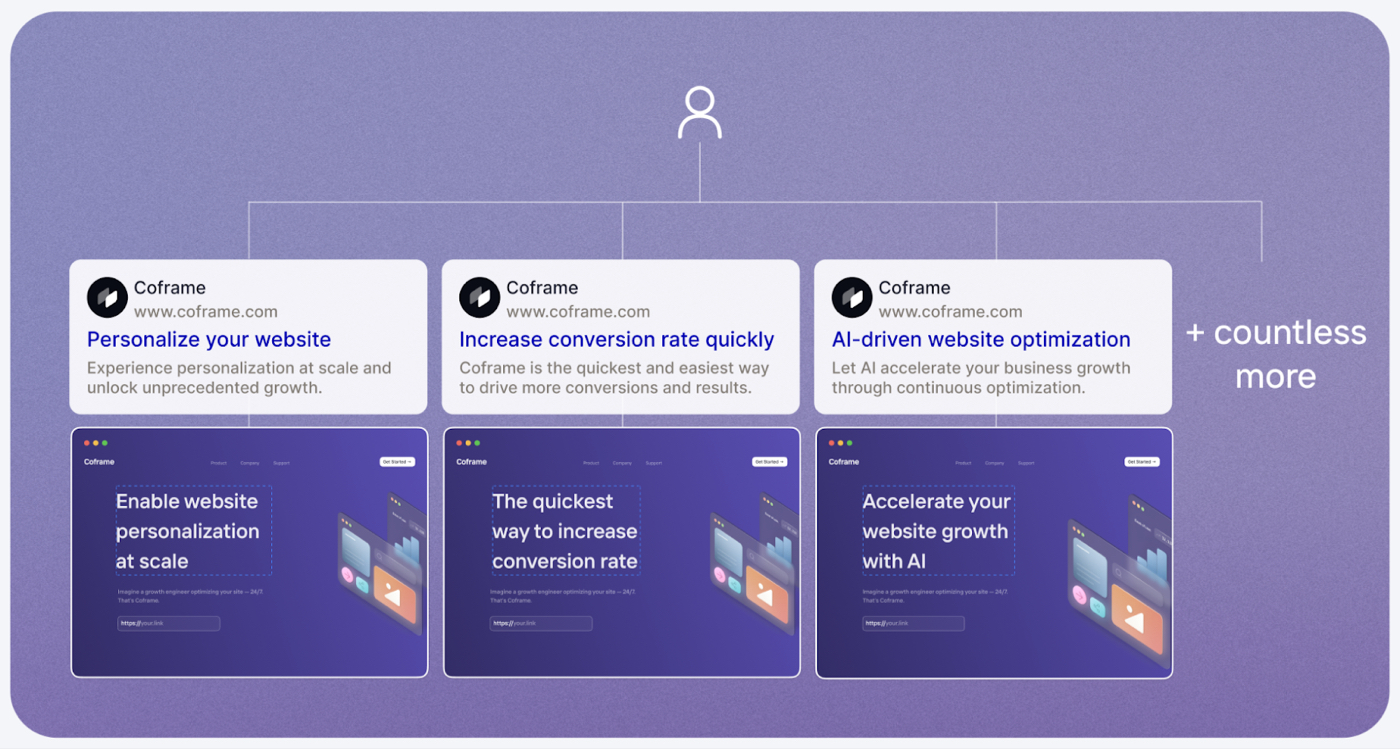

Large-scale personalization: A different experience for every user

As a business grows, the number of audience segments typically does as well. And while ads, keywords, and referring websites can each yield a very large number of distinct audience segments, the number of segments a team can effectively target is limited by human bandwidth. When done manually, this process is highly tedious to run and manage, and is intractable at true scale.

But as we’ve seen above, it’s comparably easy for machines to strategize, develop content, deploy experiences, and learn from the results. By setting guardrails and having humans verify instead of creating the content, businesses can ensure these experiences are highly relevant and personalized for far more people.

AI helps personalize a website based on search ads at scale. Source: Coframe/the author.While it’s much easier to verify outputs than it is to create them, at some level, even verification becomes difficult to manage. This principle extends to quant experimentation broadly. Fortunately, this is another area that generative AI excels at: By rigorously defining precise parameters and rules by which outputs must abide, we can also have the AI perform checks at scale, drastically reducing the risk of problematic outputs (this applies to content created by humans as well). And while not yet practical due to the current cost of token generation, you can see where this might be headed: total one-to-one personalization—a different page, site, and experience for each customer.

This is only the beginning. We see companies starting to discover and deploy more advanced quant strategies in all aspects of marketing and growth every month. As with any tool, quant experimentation requires its own artisanry and judgment—indeed, an entirely new way of thinking. In quant trading, traders carefully define a clear strategy with a scope and guardrails before letting the machines loose. The same is true in quant experimentation: A high-level strategy is defined, specific elements of the user experience are scoped, and guardrails are put in place. Then the machines do what they do best: optimize.

Josh Payne is the founder and CEO of Coframe. You can follow him on X at @joshpxyne and on LinkedIn, and Coframe on X at @coframe_ai and on LinkedIn.

To read more essays like this, subscribe to Every, and follow us on X at @every and on LinkedIn.

We also build AI tools for readers like you. Automate repeat writing with Spiral. Organize files automatically with Sparkle. Write something great with Lex.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

.png)

.png)

Comments

Don't have an account? Sign up!