When I was coming up in tech, the conventional wisdom was that working at or investing in software companies was a great way to make money, while doing so with companies that took on scientific risk or produced hardware components were a wonderful way to lose every cent to your name. This has always struck me as, you know, wrong, which is why this piece by venture capitalist Leo Polovets resonated with me. He takes a data-driven approach to understanding how deep tech companies can produce superior financial returns. If you’re on the fence with your career—perhaps facing temptation to do something relatively safe in B2B SaaS—take this piece as a rational encouragement to dream bigger. —Evan

I’ve been a venture capitalist for nearly 11 years. While most of my investing career has been focused on B2B SaaS with Susa Ventures, two years ago I decided to try my hand at deep tech. So I started Humba Ventures, which leads pre-seed and seed rounds in deep tech investing—sectors like robots and manufacturing, climate and energy, and defense and security.

Historically, VCs have stayed away from deep tech because it’s considered a hard industry to build in. Deep tech startups tend to have significant science and engineering risk, and it’s not always guaranteed that the products they plan for can actually be built. Compare that to SaaS, where there is rarely a risk that a product can’t be built. Instead, the risk is whether the product is worth building, and whether anyone will pay for it.

Other factors have helped fuel the stereotype that deep tech is a difficult sector. In the past, there hasn’t been much follow-on funding for startups or successful predecessors to hire from. And a few outlier companies have created the reputation that deep tech companies burn a lot more than their peers.

But these stereotypes are wrong. In fact, now is the best time to invest in deep tech companies. There are lots of macro tailwinds fueling this phenomenon, including physical solutions that are needed to reduce climate impact, bring manufacturing back to the U.S., and defend ourselves against global threats. And as traditional startup sectors face cutthroat competition, with generative AI dropping costs of building new software products, deep tech’s higher barriers to entry can allow any team willing to surmount them to reap huge rewards.

Not all my beliefs are macro. I’m an engineer and data guy by training, so I decided to dig into some PitchBook data. And the data has said the same thing. Deep tech is the best place to invest in and build right now. In this piece, I’ll cover three misconceptions about deep tech in detail

Aren’t deep tech companies more capital intensive than traditional tech?

On average, no!

Look at every list of “most funded companies.” They are almost exclusively traditional startups, in areas like marketplaces, fintech, and social networking. These are companies like Uber, WeWork, and Oscar, which spend orders of magnitude more than most deep tech businesses.

When the barrier to entry for building a product is low, companies need to execute quickly and pay heavily for customer acquisition. This can quickly get expensive. Deep tech companies typically face less competition, so they can spend more of their resources on developing unique IP than on paying for customer attention.

Additionally, deep tech companies have access to grants and other non-dilutive funding, as well as larger contract sizes. Take the defense industry. The Department of Defense awards multiple eight-nine-figure contracts daily. Any startup that captures a few contracts of this size is basically a $1 billion-plus-valuation company.

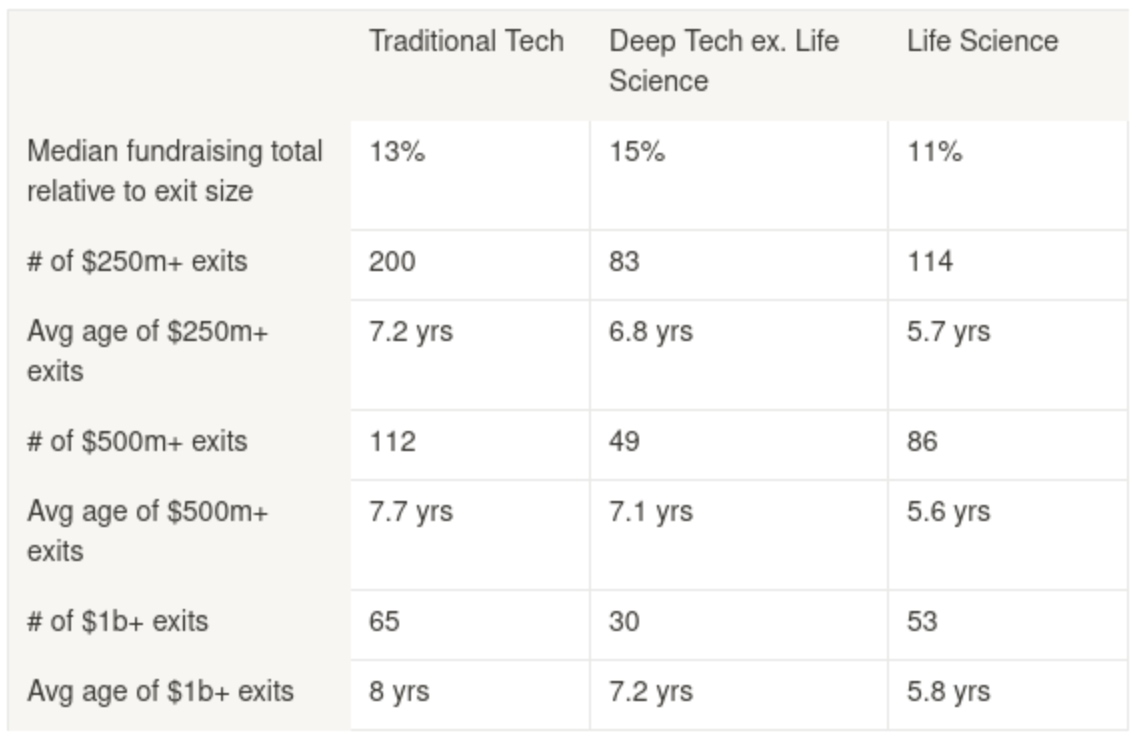

The reality is that both traditional and deep tech companies are similarly capital intensive. Here’s a summary of PitchBook data for companies founded since 2010 in the U.S. and Canada that have had exits greater than $250 million:

Source: Pitchbook.

The median company has raised 11-15% of its exit size in prior funding—running counter to the common assumption that it takes more than $500 million in funding to get a $1 billion-plus exit in deep tech.

The table also reinforces that there meaningful exits across all of these categories. They are all good territories for founders and investors to explore.

Do deep tech companies have good, timely exits?

Yes!

Deep tech industries are ripe with good outcomes, with companies going from early-stage startups to exits. Many deep tech industries are huge, and there’s often a lot of room for new players: in the U.S. alone, observe the market size of batteries ($100 billion), pharmaceuticals ($1.5 trillion), defense R&D ($150 billion), and industrial and warehouse automation ($200 billion).

There are several promising exits that have happened in these industries. Here’s a sample from just the past five years:

- 10x Genomics ($4.7 billion, gene sequencing tech)

- Archer Aviation ($1.7 billion, electric aircraft)

- Auris ($3.4 billion, surgical robots)

- Cylance ($1.4 billion, antivirus)

- Foundation Medicine ($5 billion, genomic profiling)

- IONQ ($2.3 billion, quantum computing)

- Luminar ($1.5 billion, LIDAR)

- Mazor Robotics ($1.6 billion, surgical robotics)

- Nextracker ($9 billion, solar panel positioning)

- Nuvia ($1.4 billion, chipmaker)

- Planet Labs ($2.8-billion IPO, satellite imaery)

- Quantumscape ($3 billion, lithium battery developer)

- SentinelOne ($5 billion, security platform)

This doesn’t include the rise in valuable still-private companies like Anduril ($10 billion), Locus Robotics ($2 billion), Redwood Materials ($5 billion), Relativity Space ($4 billion), Solugen ($2 billion), and, of course, SpaceX ($150 billion).

I think we’ll continue to see more and bigger outcomes in these spaces in the next few years. Many industries and problems can benefit from deep tech innovation, and either have no incumbents or old ones. For example, I’m an investor in Mashgin, which uses machine learning and computer vision to power an AI self-checkout product. Mashgin can instantly figure out everything a customer is buying, while all of the incumbents I’m aware of are still working on manual barcode scanning.

And winning an incumbent’s market can yield immense returns. Take ABB, which is a leader in industrial automation ($30 billion in annual revenue). It’s also a merger of two companies founded in the 19th century. It feels likely that the best entrepreneurial minds from SpaceX, OpenAI Microsoft, and Tesla will be able to make inroads against ABB’s market leadership in the next decade.

Additionally, the table in the previous sections shows that deep tech and life science companies actually exit 10-25% faster than their traditional counterparts. The average company age for exits above $500 million is under eight years for traditional companies, over seven years for deep tech companies, and under six years for life science companies.

My hypothesis is that deep tech companies that build valuable IP can have meaningful exits quickly. On the other hand, traditional tech companies rarely have very strong IP and are mostly acquired based on strong traction. And it often takes longer to get to meaningful traction than to accumulate valuable IP. As a result, deep tech VCs value strong founding teams even more highly than traditional VCs. If the team is good enough to produce unique, valuable IP, then they are likely to experience a good exit.

Isn’t the rate of big outcomes low?

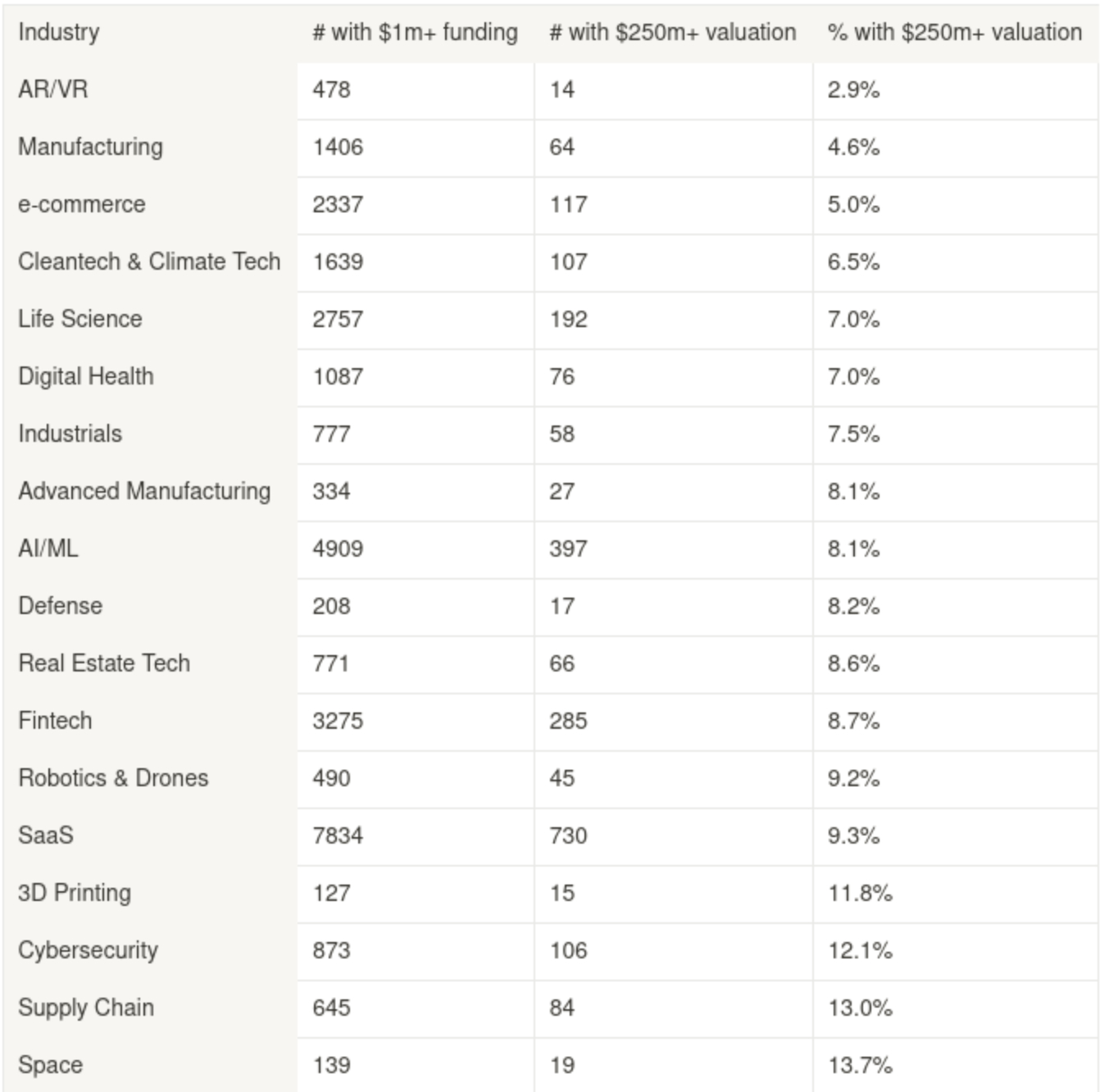

I found this the most interesting misconception to debunk. I got data across 15 sectors for companies started since 2010 with at least $1 million in VC funding. I wanted to estimate the chance of a company with some VC funding eventually reaching either a $250 million-plus valuation or a $250 million-plus exit. I picked $250 million as the threshold because I consider this a good outcome. And at higher levels, like $1 billion, the data gets sparse.

This table is sorted by the odds of hitting $250 million-plus. Most categories are in the 7-9% range, with a few outliers on both sides. Deep tech sectors fare quite well here (except for AR/VR 😢). Almost regardless of category, your chance of hitting a $250 million-plus valuation is around 7-9%.

Of course, valuations are secondary to exits. Here’s a table of relative frequencies of $250 mllion-plus exits in each category.

Here, deep tech actually dominates traditional tech. Defense, space tech, and life science companies have 2-5% odds of having $250 million-plus exits, while companies in categories like SaaS, fintech, and AI/ML have 1-1.5% odds.

If you look carefully at the table, you might notice that the odds of good exits in deep tech categories are often higher. However, the number of good exits in these categories is lower. This is a hint at why these companies tend to be more successful.

Building a deep tech company is hard—really hard. You’ll typically need a multidisciplinary team that’s exceptional in multiple areas, which creates a very high barrier to entry. But if you can assemble such a team, then you will have much less competition than most startups and a greater chance of a good outcome.

For example, we recently invested in Antares, which is developing nuclear microreactors for defense applications on earth and in space. A good team will need to know how to build reactors, how to sell to the defense department, how to deal with regulations, and so on. It’s very hard to assemble a team like this, so there are only a few microreactor startups. If you’re good enough to enter the space and get funded, you’ll be one of one or three or 10 companies fighting for market dominance, not one of 500. So founding teams that are strong enough to get funded in the first place can have better expected outcomes.

Now is the time to build in deep tech

To summarize the data:

- There are many $1 billion-plus deep tech exits.

- While the absolute number of strong exits is smaller in deep tech than for traditional sectors like B2B SaaS, the rate of good exits is approximately twice as high.

- On average, good exits for deep tech companies come 6-24 months sooner than good exits for traditional tech companies.

- On average, deep tech companies have similar capital intensity to traditional tech companies. Across all exits above $250 million, the average amount of capital raised is about 11-15% of the sale price, regardless of sector.

And while I’m focusing on the financial performance of deep tech companies, investors and founders in this sector should also consider that they bring the opportunity to have a monumental impact on the world. Most startups have a big effect on some group of people. But while software companies might have an audience of accountants or barbershop owners, deep tech companies might reduce energy costs or improve our defense systems, thereby impacting everyone.

Now is a better time than ever to build deep tech companies.

Leo Polovets is a general partner at Humba Ventures, an early-stage deep tech fund in the Susa Ventures fund family. Before co-founding Susa and Humba, Leo spent 10 years as a software engineer. Previously, he was the second engineering hire at LinkedIn, among other roles. This piece was originally published in his newsletter.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!

You produce amazing articles of interest to professionals who are in software development or financial investing in technology companies. That's such a small slice of the total industrial, and professional pie and I wonder if this is the niche Every wants to claim as their core?

Please write more about deeptech. Like new ideas, startups, technology, etc. This is article is an amazing insight into a risky but a bit untapped area of making career.