“That's one thing Earthlings might learn to do, if they tried hard enough: Ignore the awful times and concentrate on the good ones.”

― Kurt Vonnegut, Slaughterhouse-Five

I was 20 years old when I used my first credit card. One night in college I was working as a pizza delivery driver when my car broke down. It was late, there was a pothole, and my tire quite literally snapped off. I was sitting on the side of the road trying to call a tow truck and thinking about how I would be able to work tomorrow–worried if I’d lose my job–and how I’d afford rent if I didn’t work. Finally, the car got to the shop and they told me it would cost two thousand dollars to repair it. I didn’t have that kind of money.

I remember how scared I was not knowing how I could afford to repair my car, but then I remembered my credit card could provide me with the liquidity I needed. It wasn’t the cheapest money I could have used but I didn’t know any better and, regardless, the resolution of my crippling stress, anxiety, and fear was well worth the price I paid in interest.

I didn’t know much then but I knew that money helped me.

Fast forward to 2017. That fearful moment set me on a path to understand how finance worked and make it more accessible for others. I graduated and went on to get a masters in economics and statistics, and eventually another in data science and machine learning. I worked at financial institutions like AIG and the Commonwealth Bank of Australia.

Then a moment came that felt rather significant: I was approached by Goldman Sachs to join their consumer bank, Marcus.

It was a great opportunity not because it was Goldman but because I believed in the product they were building: a simple loan with transparent costs and no fees. What a wild product idea: transparency. Somewhat shockingly, this was novel at the time as many lenders had hidden fees and costs but Marcus is consumer-centric and I loved that.

I truly did love my time there and I actually thought I’d never leave...but I couldn’t help but notice a common theme in postmortems we were doing on non-performing loans: many of them were originated by Hispanics/Latinos. To be fair, they were not the worst performing loans, but as a Latino myself, these data points stood out to me.

As someone who grew up working class with immigrant parents from Mexico in the South side of Chicago, I thought to myself “Maybe I could build a product to help my community.” On paper, given my finance, technology, and personal background I was (arguably) uniquely positioned to do it.

So in 2019, I left Goldman to start my own company: Unidos. I built a personal financial management tool in both Spanish and English that aimed to educate and empower my community with a simple understanding of finance and interest. After 3 years, I can objectively say it was an utter business failure.

Which is the primary reason I am writing this article: to vent all of the mistakes I made so that, hopefully, you (and maybe even future me) can avoid them.

Remember, most startups fail which means that in probability if you are going to launch a startup, you will probably fail, too.

Be bold. Reject this data anyways but avoid the mistakes I once made.

All of the ways I failed as a founder

Some important facts about my experience as a founder:

- I did not have any previous experience as a founder

- I did have lots of experience at big companies

- I was a very technical founder

- I had significant misalignment with my cofounder

- I was working full-time while doing my startup

- I did not ever try to raise any venture capital

(I should note that I was occasionally approached by investors and I politely declined. It was mostly because I thought my business model was terrible and that’s probably a good sign I should have changed it but oh well.)

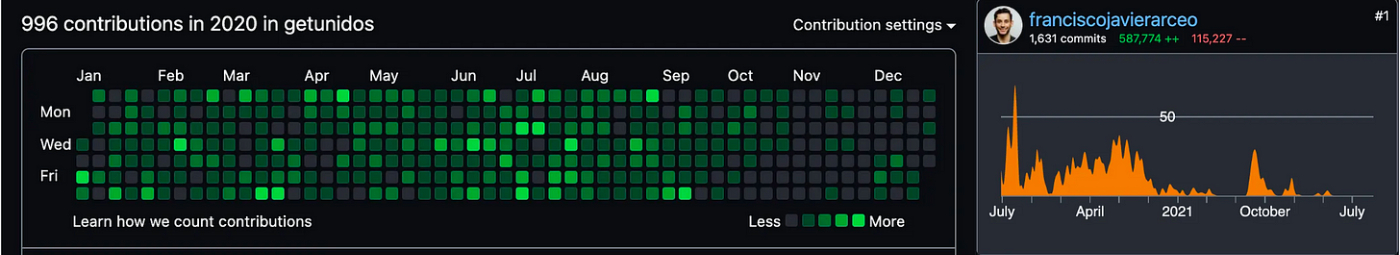

I launched the first version of the product (a web app) in 2020 and you’ll see in the photo below that I wrote a lot of code in that time…all of which only aimed to solve for what I thought my parents and I needed when we were learning about the US financial system, which was an abhorrent waste of time and obviously a very narrow target market.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!

Francisco, Tank you for being Real and putting your lessons out there. I Too have failed many times. It is also important to acknowledge the things that DID Work out. You managed to build a product that people actually used, that is HUGE. It's important to remember the Positive things about your experience too...

Y sigale chingando Cabron! Que esto no se acaba hasta que se acaba ;-)

Good lessons, Francisco.

For others reading this - remember the Anna Karenina rule - all happy startups are the same, all unhappy startups are unhappy in their own, different way. Points 1,2, and 7 are common. The "save money and do it myself" problem (in examples 4 and 9) is also very common.

Often it pays to think about saving time than money - get something in front of customers and cycle quickly. If you are getting hired help in, test them out first with smaller jobs. Learn to coax extras out of them (without pushing the friendship too far).

My experience very much validates the importance of talking to customers. It is pretty cheap and helps you not delude yourself that you *know* what customers want.

Paddy