TL;DR

There are four problems with financial information:

- Financial information no longer accounts for stock price fluctuations.

- It’s not valuable even when it does come out because other information (analyst recommendations, non accounting reports) has larger impacts on share price.

- Even ignoring capital markets effects, past earnings growth doesn’t predict future earnings growth.

- Analyst price estimates are dispersing, implying that information quality is decreasing.

The main cause is intangible assets. We have shifted from an industrial economy to an information economy, yet the investments in information assets aren’t recognized in financial statements. They are expensed instead of capitalized. It’s beneficial for investors to change accounting to capitalize intangible assets, but incentives for corporate managers and auditors make it unlikely to change.

The implication for investors? Legacy financial metrics should play a lesser role in analyzing businesses. Instead, use many quantitative and qualitative analytical methods and study how top performers have succeeded.

On December 31 2010, Amazon stock (NASDAQ:AMZN) closed at $180.00. It implied a market cap of almost $81 billion. They reported over $1.15 billion in net earnings for the year and traded at a 72.1 P/E multiple.

In the subsequent years, Amazon’s P/E ratio would fluctuate between well below zero to over 3,000. Anyone familiar with the story is aware that Amazon purposefully keeps earnings low, partially for tax reasons and partially to pass savings back to customers through lower prices.

But what if you had tried to trade their stock on the P/E ratio?

At times, like at the end of 2010, Amazon was expensive for an online retailer. Perhaps you, as a savvy investor, would assume the stock is too expensive and decide to pass on it.

At other times, it just didn’t make sense. The P/E ratio was useless when it came to analyzing Amazon.

And despite earnings metrics being meaningless, Amazon was one of the best performing stocks of the past decade, returning over 1,000%. If you relied on this information, you would’ve missed out.

The Amazon situation highlights a bigger issue with accounting: financial statements aren’t useful anymore. The best businesses in the world have built their wealth on intangible assets. And half the time accountants don’t recognize they even exist.

In this article I summarize and build upon The End of Accounting by Baruch Lev and Feng Gu, a book about the decreasing value of financial statements for investors. It’s never been more relevant as we continue to see high-multiple companies outperform over and over. Let’s get into it.

Problem #1: Financial Metrics Don’t Influence Stock Price

The first point The End of Accounting makes is on the deterioration of the predictability of financial information on market prices. Financial statements (and accounting) are no longer serving their original purpose: to inform investors of the operations of a business.

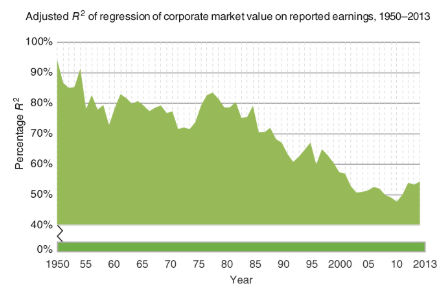

The first thing they analyze is the effect that reported earnings has on market value. As you can see, the impact has moved from highly predictive (80-90% R squared in the 1950s) to loosely predictive (45-55% R squared in the 2010s).

As a reminder, an R squared of 100% means that a change in the independent variable perfectly predicts the response in the dependent variable. So in this case, 60 years ago a change in earnings would account for 80-90% of the change in market value where in the early 2010s it only accounted for 45-55%.

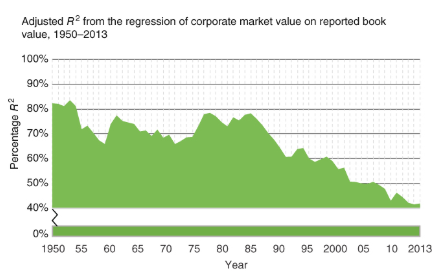

Reported earnings isn’t the only financial metrics that follows this pattern. Here we see the impact of reported book value on market value.

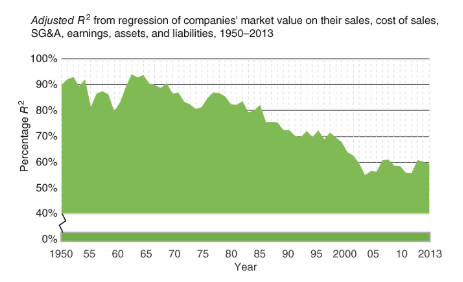

And then a multivariate model that compares sales, cost of sales, SG&A, earnings, assets and liabilities to market value.

The takeaway? Only ~50% of market cap variation is explained by changes in financial information. If you successfully predict the earnings of a business, there’s a good chance the stock won’t respond in alignment with the news. Making money in the stock market is more complicated than accurately predicting the future.

Problem #2: Financial Information Is Not Timely

So if the usefulness of financial information is deteriorating, what information are investors using to trade stocks?

In order to answer this, we turn to Claude Shannon and Warren Weaver, two twentieth-century American scientists, who developed an all-encompassing communications theory. The theory broke down a message into components influenced by the sender, the channel and the receiver.

One of the conclusions they made was that the receiver of the message had a large role in determining the information value of a message. If the message was surprising, it had high information value. If the message wasn’t surprising, it had low information value. From page 87:

The theory provides a measure of the amount of information conveyed by a message. For example: “It will start raining at 3:00 p.m. tomorrow.” This measure is based on the extent of surprise, or unexpectedness of the message to the receiver. If, for example, it is now November in Seattle, and it rained heavily the whole week, a forecast of rain continuation tomorrow isn't that surprising, implying a low information content of the “rain tomorrow” forecast. If, in contrast, the 3:00 p.m. rain forecast is issued in the summer in an arid area, like the Middle East, the same forecast is very surprising and therefore highly informative and useful (the action called for: plant seeds today). Information content is thus a function of the surprise, or newness of the message, to the receiver. [Emphasis mine]

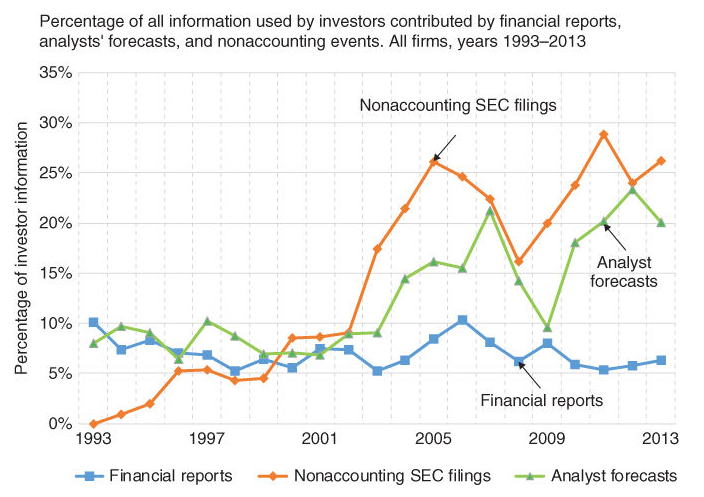

By using this framework, we need to measure how surprised the receiver is when they receive the message (in this case, a quarterly or annual report). To measure that, the authors looked at three types of information — nonaccounting SEC filings, analysis forecasts and financial reports — and compared it to changes in the stock price. If the price moved directly after information was released (in either direction), it’s deemed valuable information.

Since 1993, financial reports have plummeted from the most important to the least important source of information for investors. We don’t care that Apple earned $2.58 earnings per share last quarter. We care about new product releases, changes in management, or regulatory hearings — none of which is financial information.

Problem #3: Earnings Don’t Predict Earnings

One thing you might notice about the first two problems is that they both connect back to capital markets. They measure the impact of financial information on the stock price, which is publicly traded in an open market. What if the problems are on the market side rather than the financial information side?

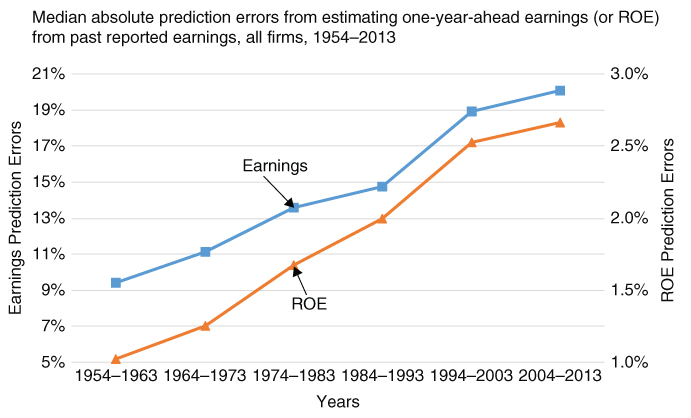

To solve this, the authors took a look at the predictability of earnings based on past earnings, rather than considering anything related to the markets. They took the average earnings growth rate from the last three years*, applied that to the next year, and compared that to what the company actually reported.

As shown by the graph below, the gap between estimated earnings and actual earnings has increased from ~10% in the 1950s to ~20% in the 2010s.

Even though past performance is not indicative of future results, history does tend to repeat itself. But this information is showing us that net earnings as a metric has been letting investors down.

*Average five-year growth rate had similar results.

Problem #4: Analyst Estimates Are Increasingly Uncertain

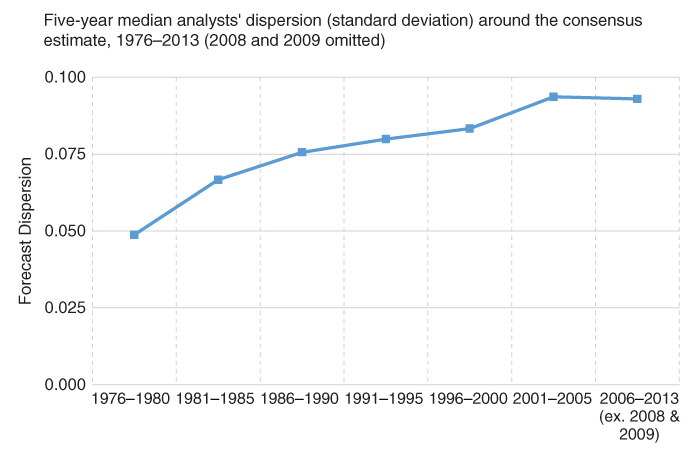

Finally, Lev and Gu make the point that if our information quality is increasing, our predictions should converge over time. If we have all these data sources, shouldn’t we see a better and better picture of reality? From page 124:

Consider, for example, three analysts following Company A, and issuing the following forecasts for its next-quarter EPS: $2.50, $2.60, $2.75. For Company B, in the same industry, the three EPS forecasts are: –$0.75, $2.0, $3.75. Obviously, in the latter case, the forecast dispersion is substantially higher than in the former, one analyst of Company B even predicts a loss. The higher degree of forecast dispersion for Company B clearly indicates a high level of disagreement, uncertainty, and even ambiguity among the analysts concerning future company performance.

To measure the effect of information quality, the authors looked at the dispersion of stock price estimates by financial analysts. If the quality of information increased over time, the dispersion would decrease. As you might expect, this didn’t happen. Instead, dispersion increased.

The Cause? Intangible Assets

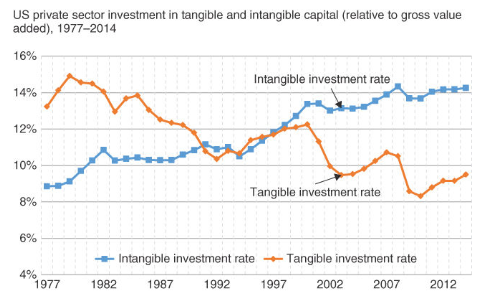

The problems with accounting and financial information stem from the 1980s and 1990s when the economy shifted from an industrial economy to an information economy.

Physical equipment and property not only used to be a larger proportion of investment, but also represented a real competitive advantage. Nowadays, assets like software, business processes, patents, and human resources have more investment and are more important. Notably, they are all intangible assets.

The idea that competitive advantage lies with intangible assets passes the gut check too. The largest companies by market cap in 1987 were IBM, Exxon Mobil, General Electric, DuPont and AT&T — which earned their advantages from either physical manufacturing or physical distribution. Fast forward to today and the largest companies by market cap are Apple, Amazon, Microsoft, Google and Facebook. All of these are technology companies (even if some have physical products). The shift from physical assets to informational assets is clear.

Expensed, Not Capitalized

The biggest problem with intangible assets is their accounting treatment. They are expensed, not capitalized.

When a company buys a physical asset, such as a machine to manufacture an automobile component, they pay the vendor in cash right away. This represents a cash outflow of the full value of the asset and is recognized as capital expenditures.

However, the full value isn’t expensed on the income statement right away. Instead, the company estimates the useful life of the asset then depreciates it each year. That depreciation increases expense and lowers income on the income statement, and also decreases the book value of the physical asset on the balance sheet. This happens with any physical asset with a useful life longer than a year.

There are two main reasons companies are allowed to depreciate assets. The first is simple: they are going to use the asset for a long time, so they should be able to pay for it over a long time. Makes sense. The second reason is so companies can get a tax break by lowering income through depreciation.

Intangibles, on the other hand, aren’t treated the same way. They only exist if a company purchases them, not if the company develops them on their own.

If one company purchases another, the value in excess of book value is recognized as goodwill (an intangible asset). But if a company spends money developing software, investing in customer loyalty through branding, or researching a new drug and patenting the discovery, those costs are merely expensed. If you looked only at financial statements, they would have zero lasting value.

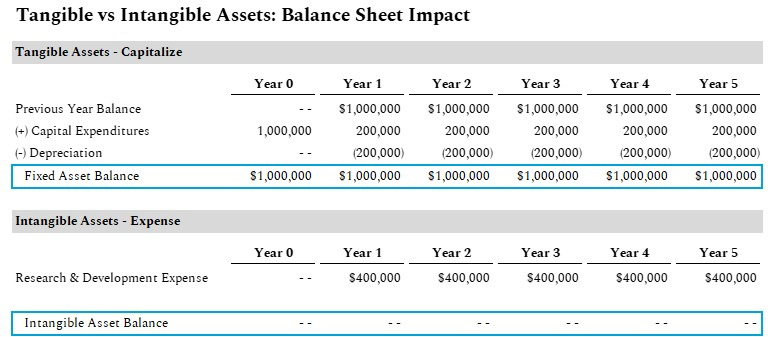

So what does this imply?

The first impact is that assets are understated. When a company invests in tangible assets, it appears as Fixed Assets on the balance sheet. With intangible assets, they are simply expensed and never seen again.

Illustrative example of balance sheet impact of tangible assets compared to intangible assets. $1,000,000 investment in Year 0 followed by $200,000 of maintenance in each of the following years compared to $400,000 per year for intangible assets. Fixed Assets are at $1,000,000 and Intangible Assets are at $0.

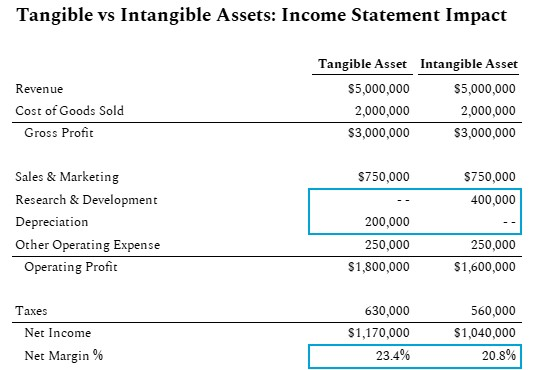

In addition to assets being understated, the other main impact is that earnings are understated. Intangible assets don’t exist, so they can’t be amortized. The result is a lower margin because they are forced to expense the whole cost each year.

Illustrative example of the income statement impact of tangible assets compared to intangible assets. Intangible asset creation is expensed through R&D, resulting in lower income.

Changing The System?

Perhaps you can hear, far off in the distance, a rowdy investors guild rioting about this madness, threatening the safety of accountants everywhere. How can this disservice be allowed on our precious financial statements?

There are actually good reasons why the system hasn’t changed yet. Well not good reasons, but understandable reasons. It comes down to incentives. There are three parties involved with the creation and consumption of financial statements: managers, auditors and investors. Two of those parties — managers and auditors — have little desire to change the status quo.

Corporate managers don’t want to add intangible assets to their balance sheets because it adds risk. Managers’ main concern is downside protection: impairing an asset is a negative event that leads to awkward questions and negative consequences. Infringement or disruption can cripple them (think Blackberry with Apple or Blockbuster with Netflix). Instead, it’s better to expense intangibles so that they never have to think about the value of them.

Similarly, auditors also want to cover their butts. In their case, they are trying to avoid lawsuits that inevitably follow large drops in share price (due to unexpected losses or business failures). Auditors would be required to audit and subsequently sign off on the value of intangible assets, and intangible assets are not easy to value. So, to avoid risk on their part, auditors also have little desire to push any changes forward.

So while it might be beneficial for investors, it will take serious regulatory overhead to change intangibles reporting.

Implications For Investors

As an investor, what does this mean for you?

First of all, it’s no longer sufficient to look at traditional financial metrics, especially ones associated with profitability. While much of the business world has adapted to the information age, accounting has not.

Instead, value intangible assets even if the company doesn’t. How much is Lululemon’s brand worth? How much are Facebook’s network effects worth? How much is Costco’s customer loyalty (earned through investing in lower prices) worth? None of these appear on the financial statements, but they are core value drivers for these businesses.

Successful investors will realize that technology doesn’t just breed new companies but also demands new ways of valuing them.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!