Sponsored By: Graft

Unlock your potential with Graft, your personal no-code platform for building and deploying AI solutions. Graft simplifies the power of cutting-edge AI, making it accessible and easy to use for everyone.

No coding expertise? No worries! Our intuitive platform allows you to seamlessly explore and apply advanced AI models. Ready to elevate your personal and professional growth with AI? Discover your potential.

Last week marked the passing of Charlie Munger —a pivotal figure in shaping Berkshire Hathaway into one of the most extraordinary companies of our era—at 99 years old. His legacy extends beyond his business acumen; Munger was a philosophical thinker whose insights have been compiled into a book, influencing millions. This article is an enhanced version of my previous analysis on Berkshire Hathaway and Amazon, offering deeper insights. It serves as a precursor to my review of a new edition of Munger's book that we'll publish on Thursday. —Evan

Amazon and Berkshire Hathaway are in the midst of an identical, potentially fatal crisis: they are simply too successful. It’s new America, one of silicon and servers, versus old America, a nation of steel and Coke syrup.

Amazon is the fifth most valuable company in the world at roughly $1.5 trillion. Berkshire Hathaway is the eighth most valuable at $776 billion. They are also revenue giants, with Amazon pulling in $513 billion and Berkshire doing $234 billion in 2022. At this valuation and revenue size, there are very few opportunities available to meaningfully grow either business. While this is a wonderful problem to have, it is a crisis nonetheless.

The two companies pursue wholly different capital allocation strategies to combat this problem. Amazon runs hundreds of experiments at once and has flailed into all sorts of large capital expenditures, from movie studios (an $8.5 billion purchase of MGM) to internet satellites ($10B in expected capital spend) to healthcare (a $3.9 billion purchase of OneMedical). Berkshire mostly does highly concentrated buyouts or public equity purchases. Its big move this year was getting majority ownership in a gas station chain ($11 billion for a stake in Pilot).

All companies face this at some point in their existence, no matter their scale. I call it the scaled-out problem: growth plateaus for a particular business line as the marginal cost to acquire additional customers outstrips their lifetime value. Companies have to diversify their markets, their product mix, or both. If they don’t, they face a slow death by decay.

This conundrum can manifest on the scale of yeeting $10 billion dollars into satellites, or it can be as simple as a local diner expanding into Sunday brunch. By examining this problem in its most scaled, most extreme version (Amazon and Berkshire Hathaway), there are truths revealed about investing and operating that apply to everyone.

Amazon’s flywheel(s)

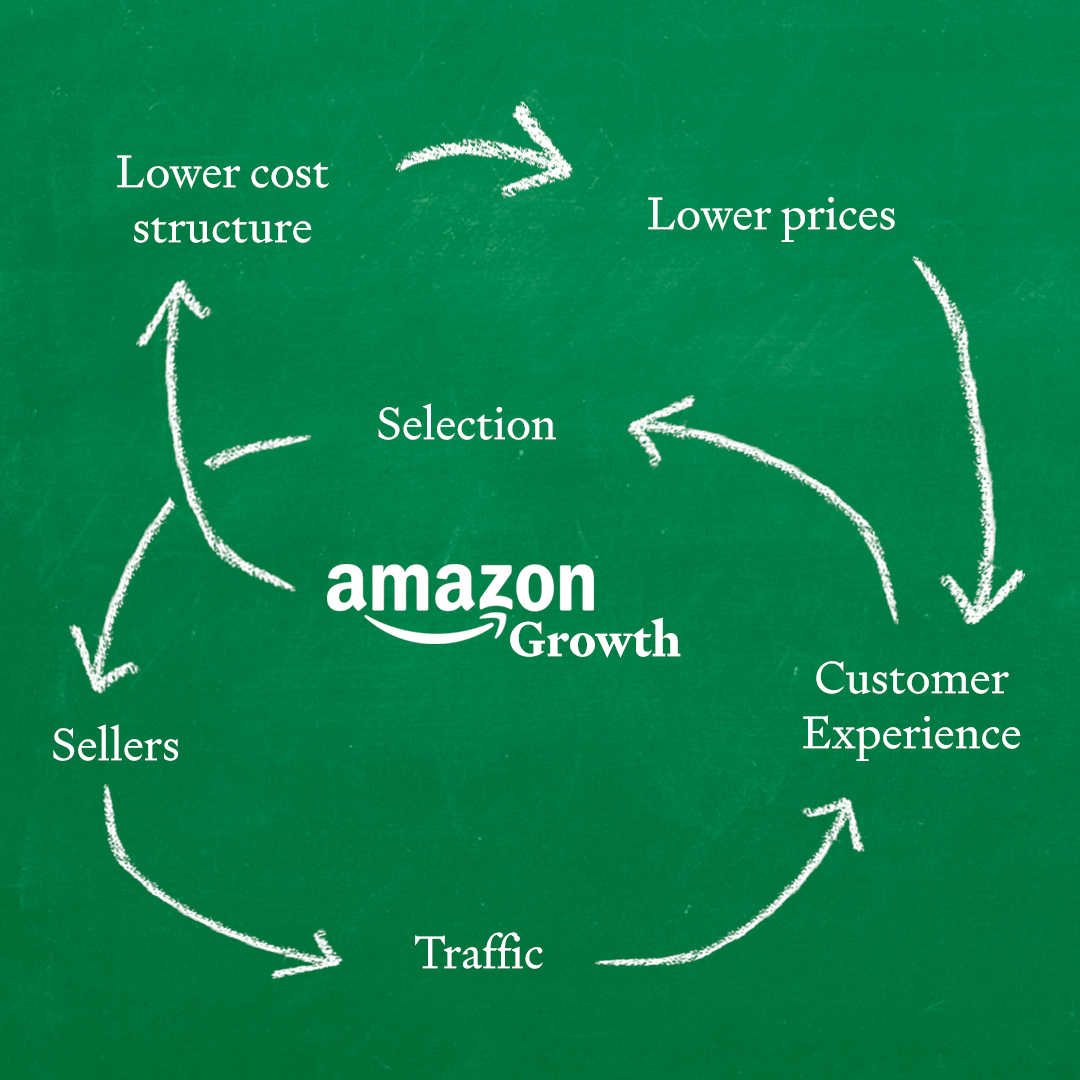

The bigger Amazon gets, the more consumers and suppliers the company has, so it can get ever lower prices and ever better selection.

Amazon’s target market is the entirety of consumer retail spending, a $8 trillion-plus annual category in the U.S. alone. While it started with books, the vision was always to become “the everything store." The initial expansion was simple. It went from books to other forms of media to children’s toys—products that were pretty similar to one another. At the beating heart of this was Amazon’s flywheel:

However, as Amazon expanded to more categories, it found that not all consumer packaged goods are created equal. During a conversation I had with a strategy lead at Walmart eight years ago, he spent an hour complaining about “toilet paper and its shitty economics.” Toilet paper is bulky, consumers are sensitive about the price, and it is relatively cheap. At the time, making last-mile delivery profitable was nearly impossible for Walmart. It is unclear to me if the company ever solved this, but there are dozens, if not hundreds, of similar problems on the path to becoming the everything store: products that look good initially end up being far less profitable then the initial customer-product fit of something such as books. Books are small and can take a beating, making them perfect for e-commerce, while toilet paper’s bulkiness and low cost made it tough to get right. All expansion happens like this—easy-to-sell products and markets progress into harder ones. Expansion means additional dollars of revenue become harder and harder to acquire.

Think of it this way: a company is powered by a flywheel, but the longer that flywheel spins, the less efficient its motion. Eventually sand gets in the gears. Each additional unit of speed is harder to gain, and you have to add new flywheels to get the machine moving again.

And this challenge began early for Amazon. Amazon’s category expansion was already difficult when the company started work on AWS in 2003—a flywheel with only marginal similarity to its plan to sell consumer goods. With the 2005 launch of Amazon Prime and the AWS launch a year later, the company successfully expanded its business. It turned out these were enormously successful bets. They shifted the flywheel of the company from that of the best retailer in the world to having the best culture of innovation in the world. They also shifted the CEO’s job to that of pure asset allocation—deciding where to make these bets.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!