To listen to an audio edition of this essay narrated by me, click here.

Your brain works fine without new oxygen for a minute or two. But past the three minute mark, you’ll lose consciousness. As each minute passes, 2 million brain cells die, causing increasingly irreversible damage. Once ten to fifteen minutes have elapsed, there’s no turning back.

It works the same way with money. All economic beings — businesses and consumers — can go a little while without income. But wait too long, and the harm becomes permanent. We might have to cancel plans, lay off workers, or lose our homes. And if we go without cash for too long, we’ll shut down.

As everyone now knows, we’re currently experiencing the sharpest cutoff of economic oxygen in living memory. Most recessions are triggered by a financial bubble bursting, like stocks in 1929, technology companies in 2000, and subprime mortgages in 2008. These shocks often feel confusing at first and then bleed slowly into the economy as the effects unfold.

But today, the cause is immediate and obvious: the economy is holding its breath because it’s the only way to escape a global pandemic without losing tens of millions of lives.

How bad is this going to be compared to previous recessions?

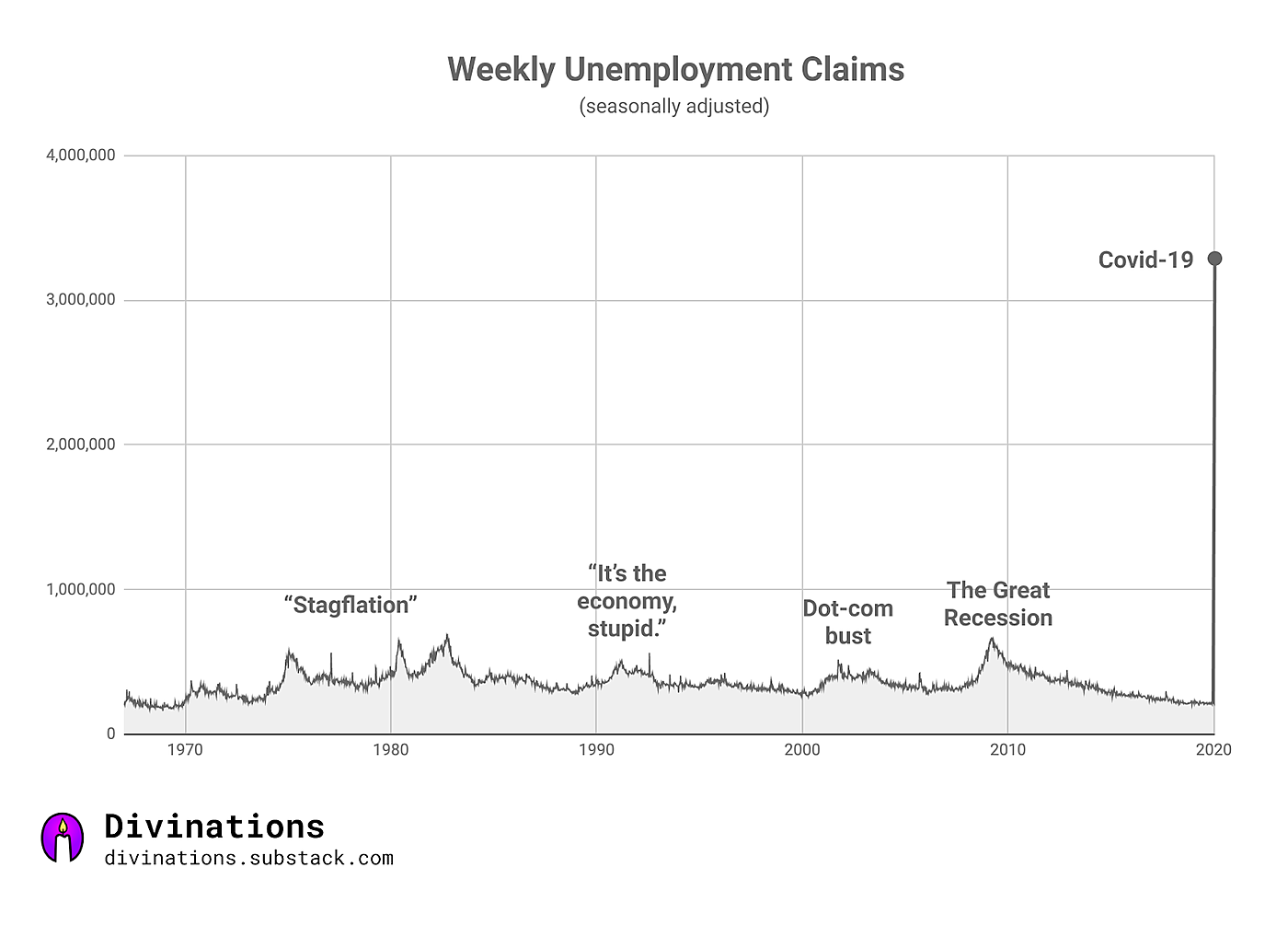

One good leading indicator to look at is the amount of people that are filing for unemployment insurance. Unlike the stock market, which moves up and down depending on the mood of speculators, unemployment insurance claims reflect the real conditions people are facing on the ground. As you may have heard, it was measured at 3.2 million last week.

To put that in context, here’s the history of initial unemployment claims going back to 1967, when the Department of Labor first began publishing the statistic.

It looks like a spreadsheet error:

It’s terrifying. We’re looking at a week with nearly 5x more unemployment claims than the worst weeks we have on record — and that was last week. The weeks to come may be even worse.

It’s important to remember: this is just one metric. It’s bad, but it doesn't necessarily mean we’re in for more pain than we experienced in previous recessions. Nobody knows how this will unfold.

“All our efforts to predict what will happen next are largely guesswork,” explains Matt Yglesias, Senior Correspondent at Vox. “Recessions have happened in the past, but they come on slowly. The kind of sudden stop in economic activity that we are looking at is well outside the realm of anything we’ve experienced.”

The good news is, even if the US was initially slow to respond, huge swaths of the population are now sheltering in place. Masks, ventilators, and tests are being manufactured and distributed where they’re needed — to an extent. It’s not clear that the federal government is doing enough, but tens of thousands of people are working hard to beat the virus as best they can.

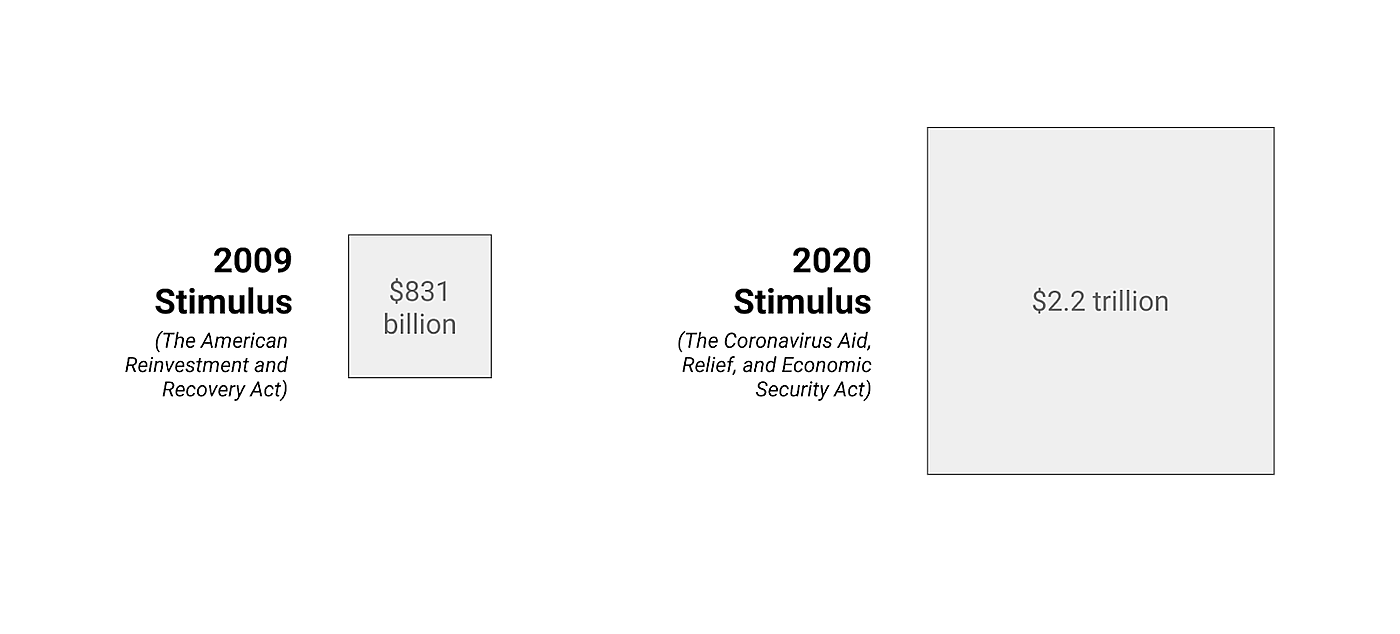

And Congress is on track attach the biggest financial ventilator in modern history to the American economy:

Well, now. What to do next?

Clearly this is an unprecedented event. Like Pearl Harbor and 9/11, it will cause permanent change. But what can we do? What strategies will guide us through our personal challenges, keep our businesses afloat, and save our economy from spiraling into collapse?

Normally, this newsletter is focused on applying lessons from the field of strategy to help businesses achieve profitability and growth. But then everything changed. It felt impossible for me to just keep doing the same thing, but I didn’t know what I could do that would help.

So I started researching the current situation. I saw that although there is now a well-developed public conversation around handling the public health crisis, the public conversation about managing the economic crisis was less advanced.

We seem stuck in a place where you have some people questioning whether the “solution is worse than the cure,” and other people rightfully pointing out that tens of millions of deaths, a crashed healthcare system, and the likely shunning we’d get from the global community would hurt the economy too.

I’d like to do whatever I can to help move the conversation forward.

Of course, plenty of people are talking about the Covid-19 recession. Economists are publishing proposals, Congress is passing legislation, and new information is whizzing around the internet as soon as it emerges. But I couldn't find anyone taking the time to zoom out and help me understand the big picture. I wanted someone to walk me through the mechanics of what’s happening, so I could get a more intuitive grasp of it.

Then I realized: maybe this is something I can help with.

...

So: what is happening? A good place to start is by understanding the fundamental dynamics of how recessions work, and why this one is so different.

Most financial panics are caused by events that are hard to understand. The mechanics of the coronavirus recession, on the other hand, are sort of obvious:

- There is a pandemic, causing billions of people to stay at home.

- This causes many people to make less money, and almost everyone to spend less money.

- Businesses then lose income, and are forced to cut costs or risk bankruptcy.

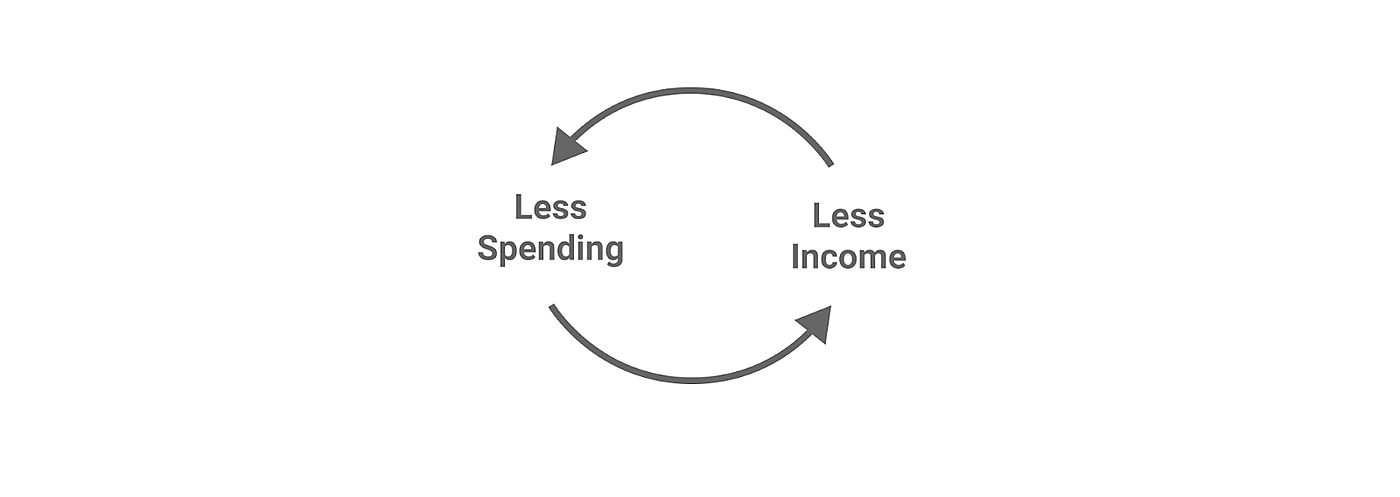

But you can see the problem, right? Step 3 causes more of step 2, which causes more of step 3, and so on, and so forth.

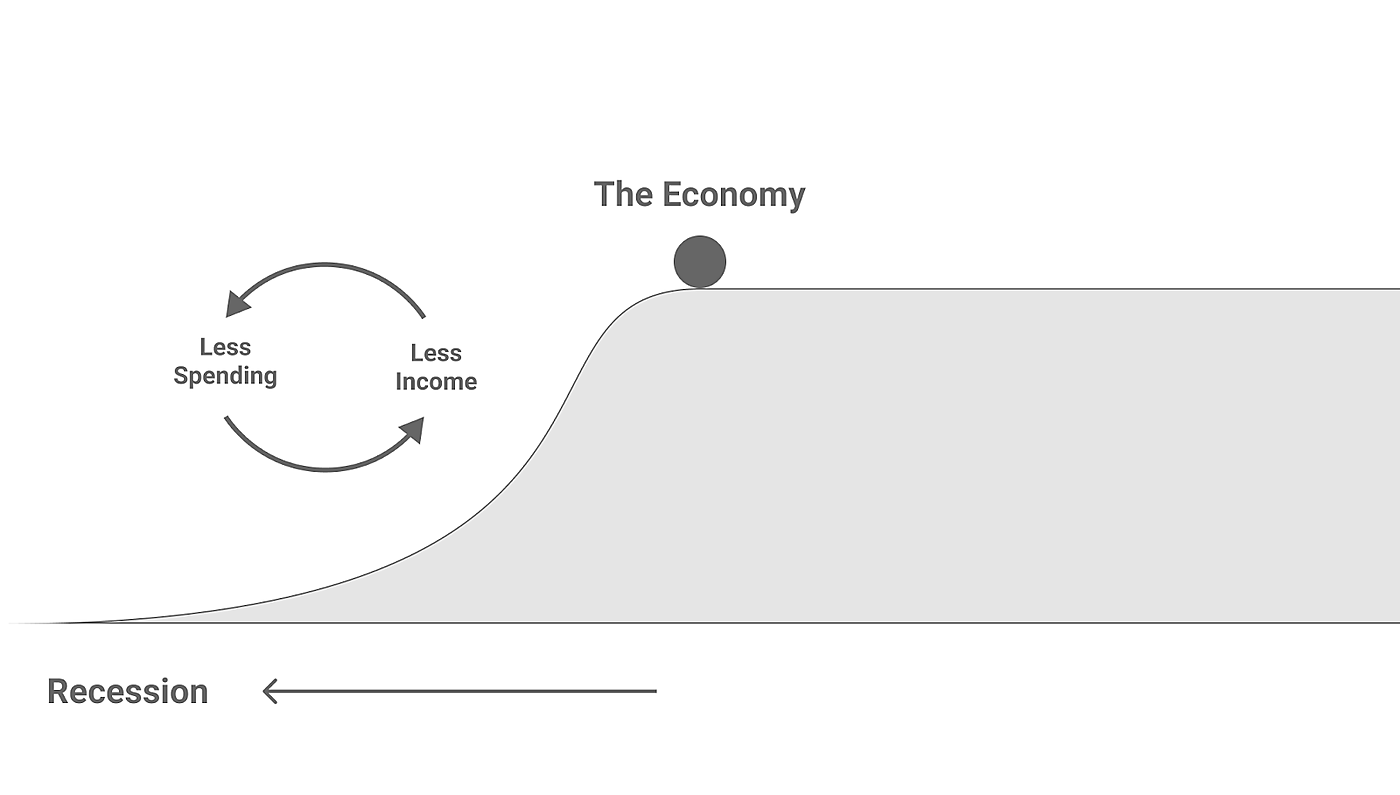

It’s a vicious cycle:

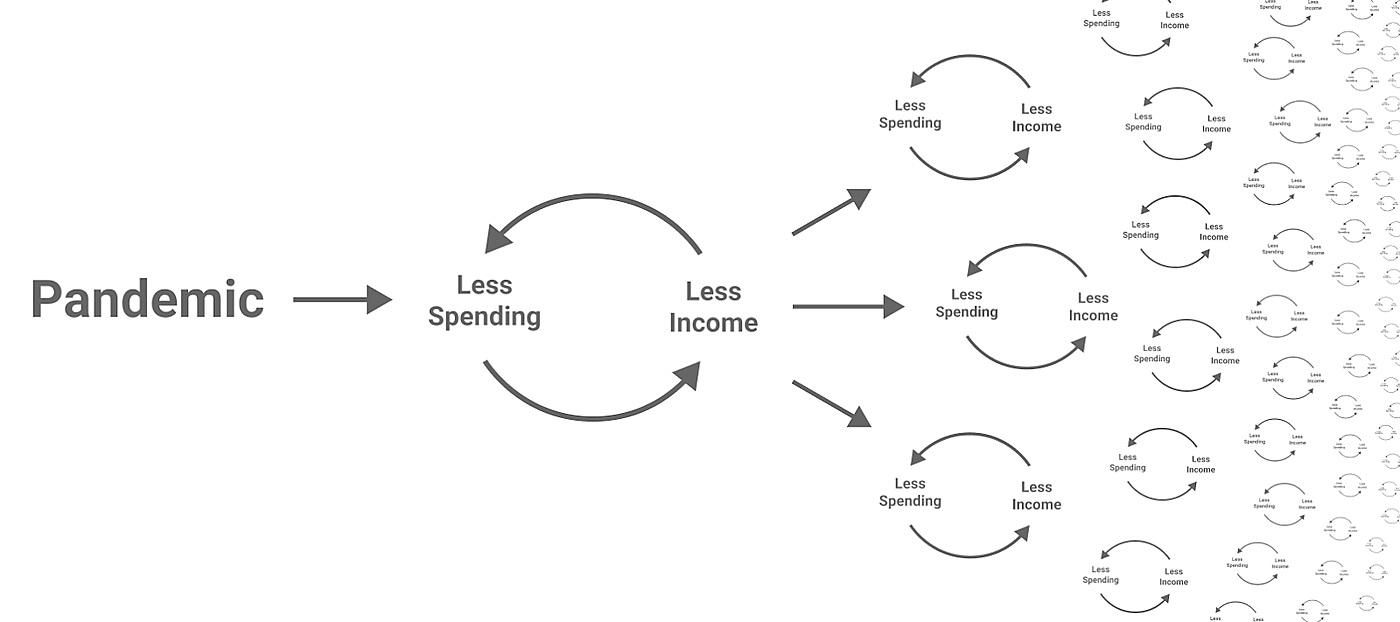

Worse, it grows exponentially, like a virus. You can think of a business that loses revenue and cuts costs because of the pandemic as being “infected.” When it cuts spending, it transmits the disease to its suppliers. Now they suffer income loss, and they might need to cut their own spending, which cascades the infection even further:

(By the way, I looked and couldn’t find anyone using ideas from epidemiology to study recessions, but it seems like a promising avenue of inquiry! If you know of anyone doing this, please let me know.)

The self-perpetuating nature of recessions makes me imagine the economy as perched on the top of a slope:

Once you start rolling down the hill, the damage accelerates. The further down you go, the more counter-force is needed to push the economy back to where it used to be.

But who could provide that counter-force?

There are two entities in most countries that do the job: the central bank, and the central government. They’re capable of doing lots of things that push the ball in one direction or another, depending on the situation.

What things can they do? How does it work? Basically: if they want to push the ball to the right, away from the recession slope, they can spend so much money that it breaks the cycle, and gets the loop spinning the other way. For example, the government might send money to workers and businesses to encourage spending, and the Fed might make it cheaper to borrow money, encouraging investment, which is a form of spending. But it gets complicated, and we’ll cover this in more detail soon.

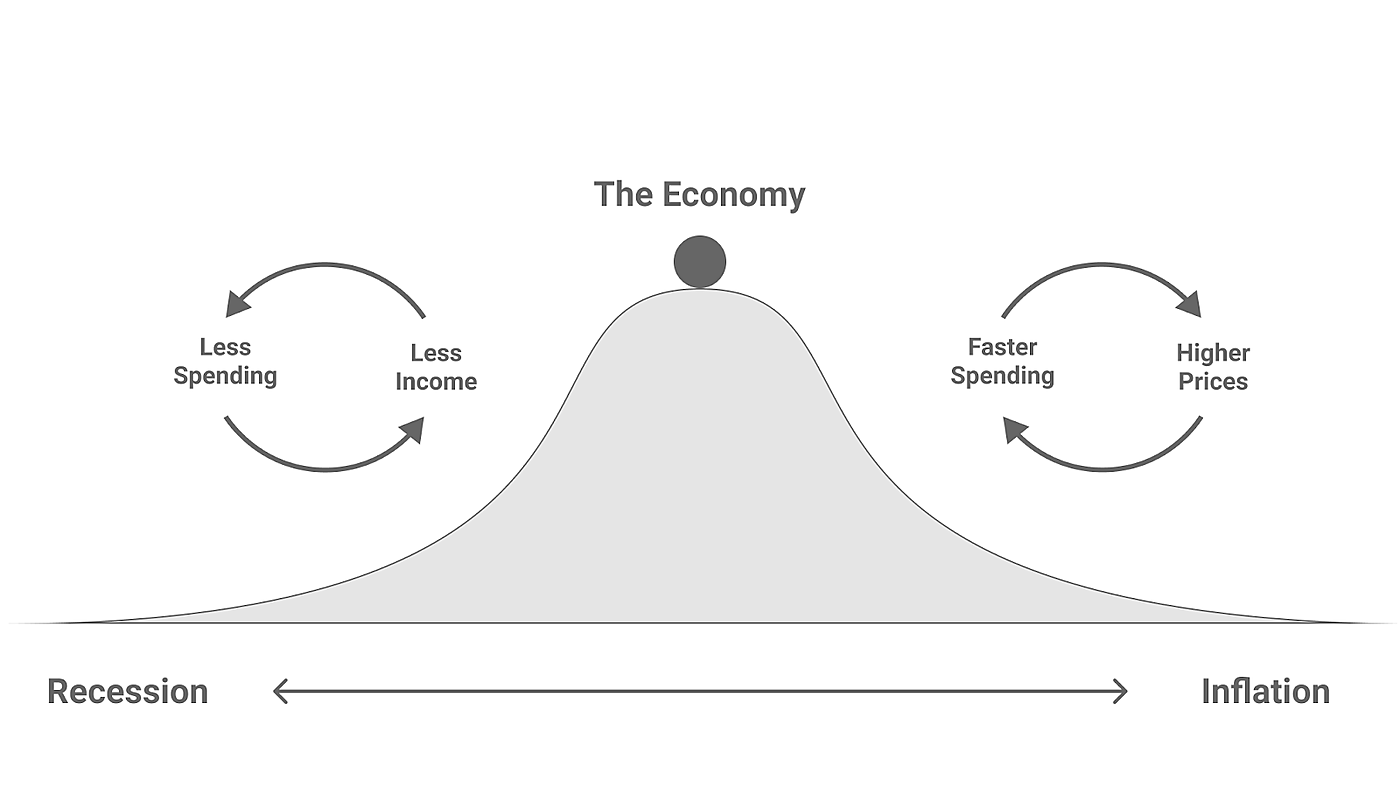

When you imagine the economy this way — as a ball perched on a slope, with the central government and bank capable of exerting force on it — it’s hard to understand why the ball would be perched in such a precarious spot, right next to the edge. Why wouldn’t the powers that be move the economy all the way to the right, just to be safe?

Because there’s actually danger in that direction, too:

Inflation is basically the opposite of a recession. Instead of spending slowing down, it speeds up. A little bit of this is good, because it generates economic growth. But if it goes too far, it can spiral into a terribly damaging cycle.

Here’s how it works:

If people spend too much too fast, then the companies that people are buying from will have to spend more to keep up with demand: more workers, more raw materials, etc. Normally this isn’t enough to lead to runaway inflation on it’s own, but what if the government prints a lot of money, or spends so much it affects the entire economy? Prices will rise, because there isn’t enough supply to handle all the demand. If everyone expects prices to keep rising, they have an incentive to spend as much as possible now. $100 today might buy you a shopping cart full of groceries, but tomorrow it’ll buy you a lot less.

So people hoard real assets, dump cash, and eventually you end up in a situation like this:

Of course, this kind of hyperinflation is rare, and usually only happens after a massive surge of money-printing. But when it does happen, it’s ruinous, so governments are careful about stimulating their economies too much. For example, in the US, the Fed targets no more than 2% each year.

This is the essential nature of the economy: it’s a delicate balance. Move too far in either direction, and things can easily spiral out of control.

In our current situation, the problem is clear: we’re down the left side of the hill. Thanks to Covid-19, we’re living through the complete vaporization of demand across many sectors of the economy.

It’s unlike anything we’ve seen before, for a couple reasons:

- We can’t stimulate demand — We need people to continue to shelter in place until we have better testing, hospital capacity, contact tracing, etc. So, for now, we can’t encourage everyone to do most of the money spending activities that the economy relies on like traveling, eating out, shopping, etc. Which means we can’t get those workers back on the job, either.

- It’s happening all at once —Normal recessions creep up slowly, as problems in one market spread to the rest of the economy. For example, nearly two years elapsed between April 2007, when the first subprime lender filed for bankruptcy, and February 2009, when the stimulus package was passed.

- The effects are uneven — Some industries have gone all the way to zero, while others are seeing unprecedented surges in demand. With a normal recession, you often see a general decrease in activity, with some sectors maybe hurt a little worse than others. This is nothing like that. We’re living, at least for now, in a totally different world, which requires a totally different economy.

These factors are causing some people to make the argument that “recession” isn’t the right framework at all to understand what we’re going through. Instead, it’s more like disaster relief.

“This is not a case where some part of the economy got out of control and we needed it to reset itself. We didn’t have a housing bubble or a dot-com bubble or anything like that,” explained Ben Casselman, an economics reporter at the New York Times. “Somebody described it to me yesterday as ‘we need to put the economy in a medically induced coma.’”

Mitch McConnell agrees. On the Senate floor this week, advocating for the $2 trillion agreement between Democrats and Republicans, he said, “This isn't even a stimulus package. It is emergency relief. Emergency relief. That's what this is.”

…

So, that’s what’s happening. But what can we do about it?

Congress is in the middle of passing the largest stimulus package in modern history — but what’s in it? What effect will it have? Are there better ideas out there? Also, what is the Fed doing, anyway?

Beyond the government response, how is this affecting our businesses? What can we do to manage it? For startups that haven’t hit profitability yet, how is the fundraising landscape changing? Are valuations down? What about the market for talent — how bad are the layoffs so far?

Most of all, as citizens, what can we do?

Stay tuned.

Was this helpful?

Please train my “neural net” and click the purple “Like & Comment” button at the bottom!

(This is no vanity exercise—the only purpose it serves is to create a feedback loop for me, so I can make Divinations better for you!)

Divinations is proudly reader-supported. Join us.

Subscribers get access to a podcast feed with audio editions of each article, and access to the ever-growing library on explainers on the most important ideas in strategy, including:

- How Competition Works— Why markets are like ecosystems, and why that means you should “compete to be unique,” rather than “compete to be the best.”

- Your Actual Competition— Michael Porter’s “five forces” framework is one of the most useful and enduring ideas in business. Here’s the Divinations explainer of it.

- Trade-offs Are Your Friend— How to use trade-offs to prevent competitors from copying you, and about how to know when you should (and shouldn’t) copy your competitors.

Postscript: My Covid-19 research goals

My goal is not to contribute new thinking, but to take the time to understand what is happening and make it easier to digest. I want this to be a space for us to zoom out and understand the big picture, but also to understand the core mechanisms that are governing our situation.

To that end, I’m interviewing people leading businesses through the crisis to learn what they’re seeing, and what’s working for them. And I plan on chronicling the changes rippling through our economy — the good, the bad, and the different — as they become apparent.

This is a unique time to practice business strategy. Incentive alignments are being put to the test, trade-offs change everyday, and the competition may be acting in unfamiliar ways. We’re heading into uncharted territory. Of course I’ll continue to publish articles that don’t talk about the Covid-19 Recession, but this is a new thread that I feel compelled to pick up. There’s hardly any other choice.

In every crisis there is an opportunity. Moments like these are the best opportunity to deepen our understanding of how the world works. It’s not just about understanding the current crisis, it’s about understanding everything — the financial system, market dynamics, how the Fed works, why recessions happen, how we recover from them, who wins, who loses — everything.

Most importantly: I want to be useful for you.

I’d love to hear how you’re doing. What changes are impacting you and your business? What are your biggest questions and concerns? Leave a comment or send me an email, I’m nbashaw@gmail.com.

I’m here to listen.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!